Trump’s Iran Shock: The ASX Stocks That Could Shine in 2026

By Dale Gillham, Janine Cox and Fil Tortevski

With Donald Trump’s latest move on Iran dominating the headlines, markets are on edge once again. History has shown that geopolitical tension can create sudden bursts of opportunity, and this moment looks no different.

According to the experts on Wealth Within’s Australian Stock Market Show, certain ASX stocks could be positioned to rally as the global energy and defence landscape shifts.

Market Turbulence Creates Investor Opportunity

Trump has announced new 25% tariffs on any country doing business with Iran, a decision sparking uncertainty across global markets. While many investors panic, Wealth Within analysts encourage calm, focusing instead on what these shifts mean for strategic ASX sectors, particularly energy, defence, and precious metals.

As market strategist Dale Gillham points out:

“It’s not about reacting to news, but it’s about understanding how to use structure, timing, and position sizing to trade smarter in volatile environments.”

His emphasis echoes Wealth Within’s ongoing approach to education: teaching investors to manage risk before chasing returns.

Learn the same structured methods through Wealth Within’s accredited Trading courses and discover how to trade with more certainty than 95% of all traders.

Energy Stocks: Unloved but Ready to Rise

With oil prices ticking higher and supply likely to tighten, energy stocks are emerging as the quiet achievers of 2026. Analysts highlighted companies like Woodside Energy and Santos as key watchlist candidates, both sitting on strong cash reserves and showing signs of technical base-building.

“These aren’t quick trades,” explains senior analyst Janine Cox. “It’s about waiting for confirmation of direction, being patient, and managing your position size properly.”

This disciplined approach is a cornerstone of Wealth Within’s Diploma of Share Trading and Investment, designed to help traders make smarter, data-driven decisions.

Defence Sector Gains Traction

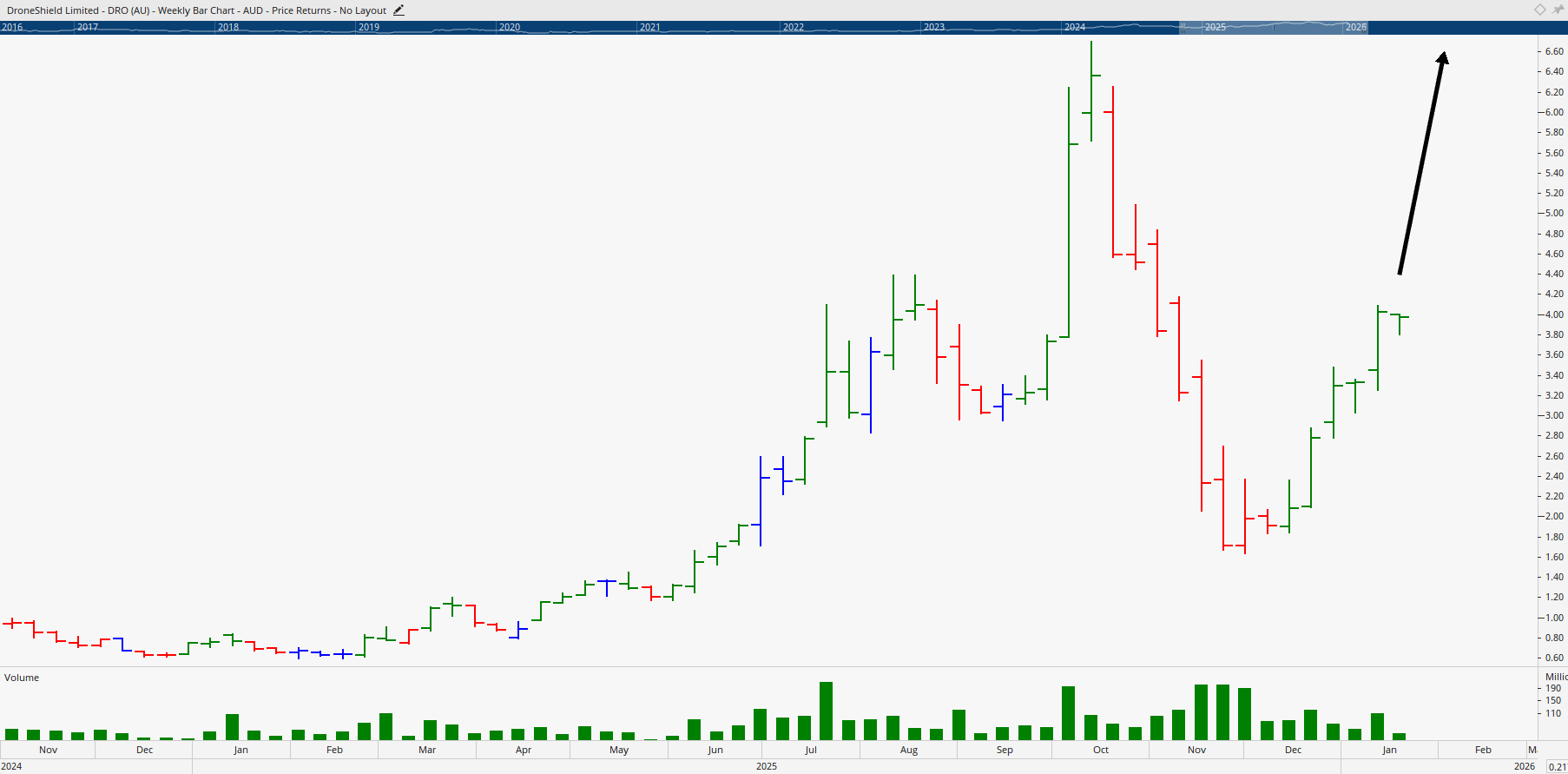

As international tensions rise, the defence sector is once again in focus. Stocks like DroneShield and emerging defence tech companies such as TTT Limited are seeing renewed investor interest. Analysts believe increased global conflict and military spending could drive this sector’s growth well into the year.

“Defence is often a safe haven during uncertain times,” notes market strategist Fil Tortevski. “When nations prepare for conflict, defence manufacturers benefit and so do investors who understand timing and technical confirmation.”

For those ready to refine their analysis skills, the Advanced stock trading course delves deeper into Elliott Wave and time analysis to help traders identify emerging trends before the crowd.

Gold and Silver – The Classic Safe Havens

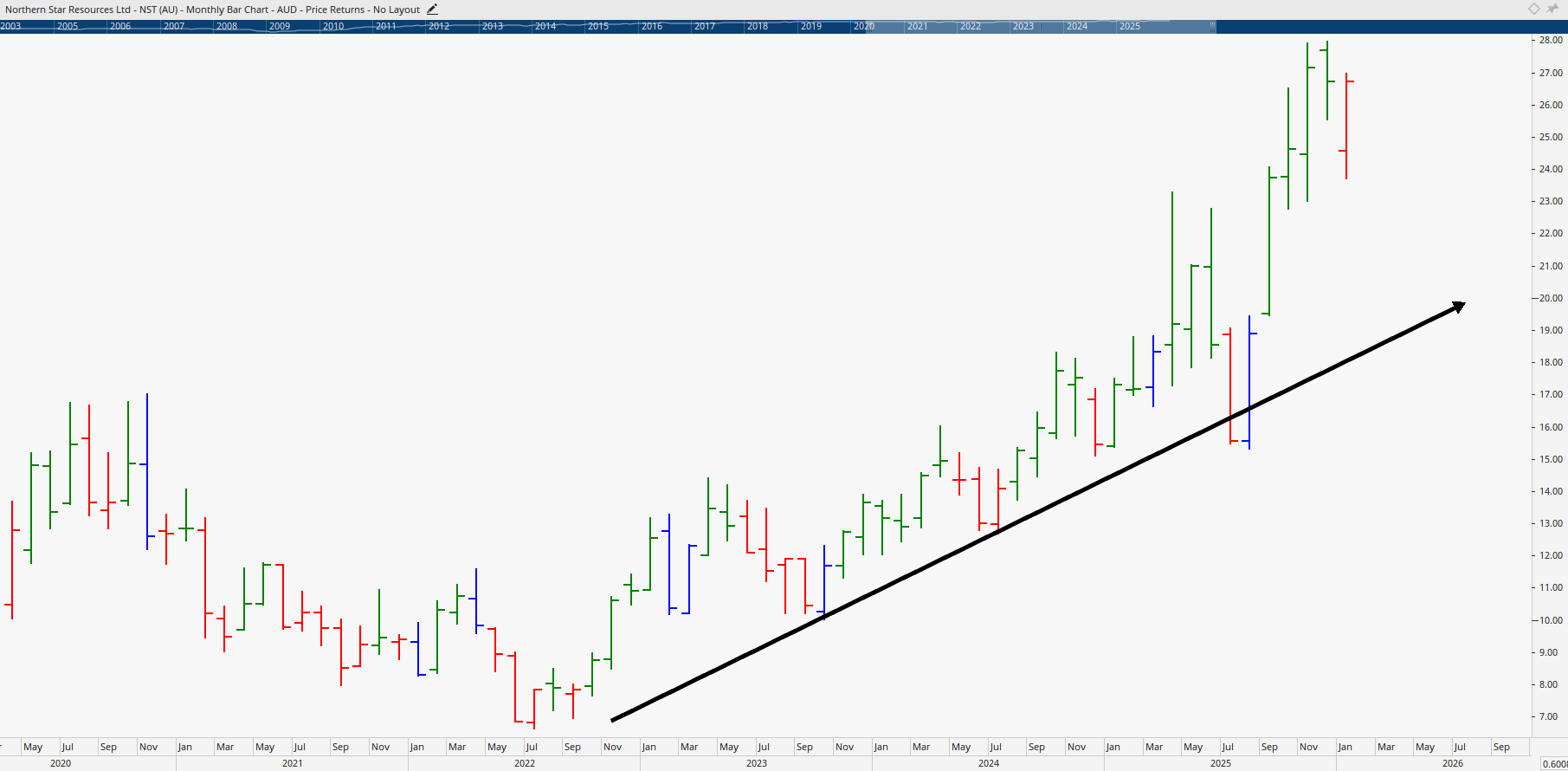

When markets shake, smart investors often turn toward precious metals. Both gold and silver have hit fresh highs, with stocks like Northern Star and Perseus Mining outperforming amid investor demand for stability.

“Gold isn’t about hype,” says Tortevski. “It’s about timing strong trends and knowing exactly where to sell, 2026 will reward those who understand exit rules.”

That mastery of trade management and timing is precisely what Wealth Within teaches through the Short Course in Share Trading which is ideal for beginners or those refining their decision-making process.

Buy and Hold? Not in This Market

While long-term investing has its merits, the Wealth Within team warns that the next few years will demand a more active, strategic approach.

Markets are entering a cyclical high, and traders relying solely on “buy and hold” could see their gains wiped out in the next correction.

“If you can’t confidently exit, you’re not managing your money, you’re gambling,” says Gillham.

He reminds viewers that education, not emotion, separates professionals from speculators. For those just starting out, Wealth Within’s comprehensive Stock Market for Beginners guide explains how to start investing safely and confidently.

Spotlight: Hot Stocks from the ASX

From Woodside Energy and Santos to DroneShield, Lynas Rare Earths, and precious metal producers, the Wealth Within analysts highlighted several strong contenders for 2026:

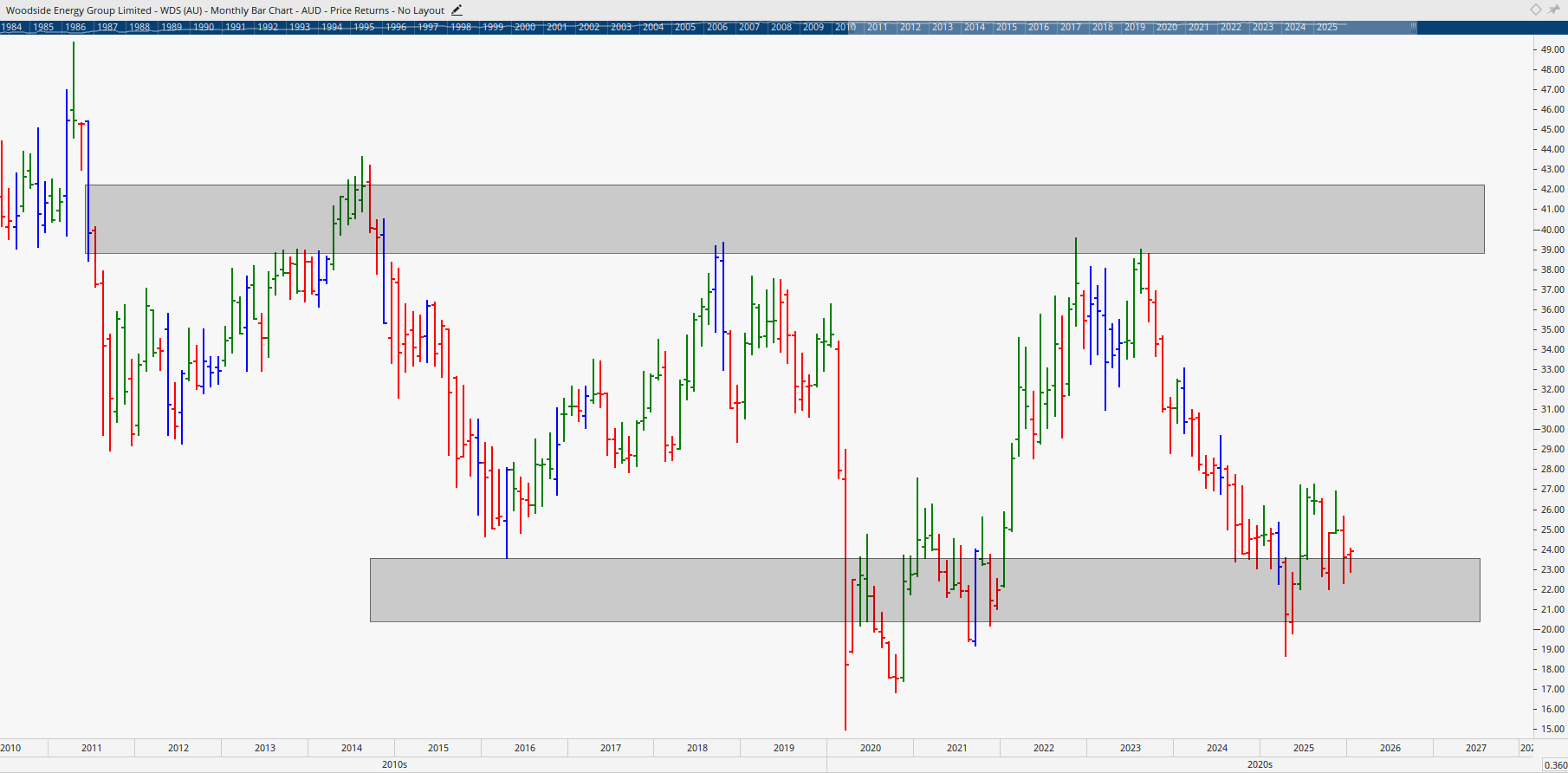

- Woodside Energy (WDS) – Watching key support and resistance zones for confirmation of an upward breakout.

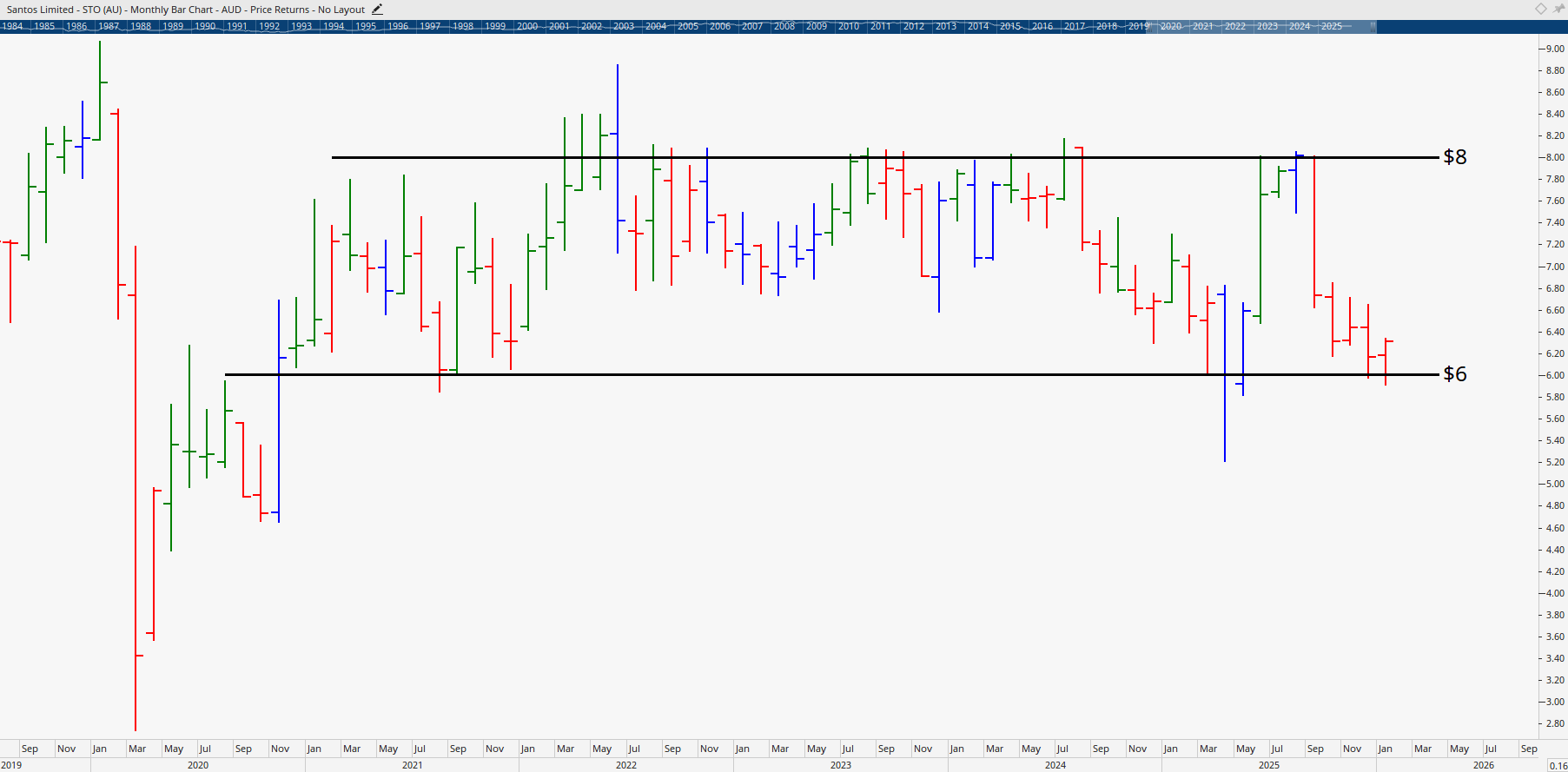

- Santos (STO) – Holding above $6 could trigger short-term trades; a break above $8 signals longer-term potential.

- DroneShield (DRO) – High volatility but strong defence tailwinds; position sizing critical.

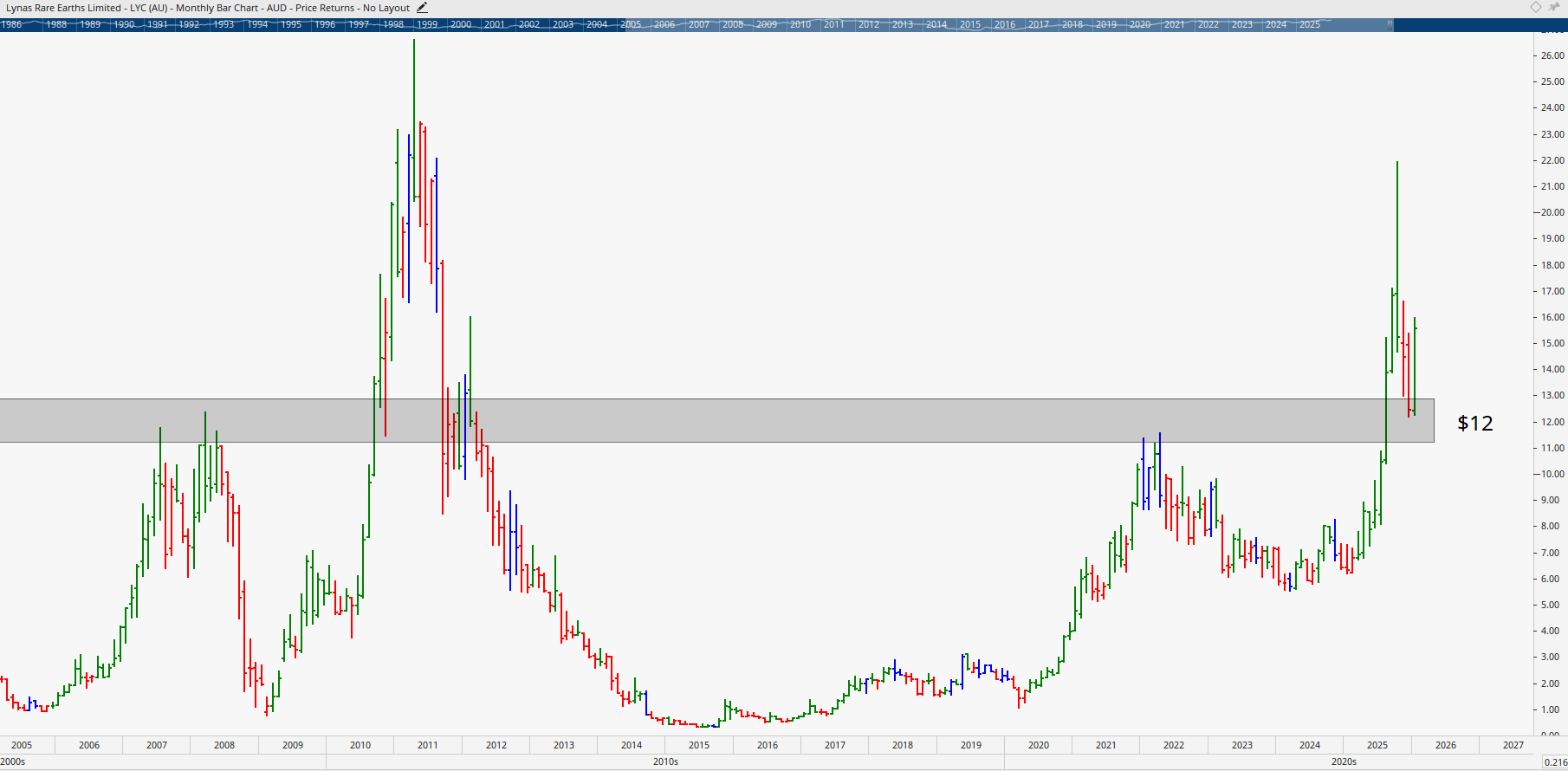

- Lynas Rare Earths (LYC) – Key bullish support at $12; one to watch as demand for EV and battery components accelerates.

- Northern Star (NST) – Momentum continuing but risk of correction after significant runs; timing exits is vital.

As the experts emphasised, these aren’t speculative calls; they’re high-quality stocks positioned within structural growth themes, backed by strong fundamentals and chart confirmation.

Watch these insights live on the Hot Stock Tips videos page in Wealth Within’s ASX video library, where each week the analysts share new opportunities and real-time market analysis.

Education First, Trading Second

Before chasing headlines or hype, Wealth Within encourages investors to start with knowledge. Whether you’re new to the market or looking to sharpen your edge, our Share trading education programs provide the framework, guidance, and support needed to trade confidently.

As Dale Gillham says,

“You trade the stock, not the story. Learn the structure, apply the strategy, and your results will follow.”

To learn more about Wealth Within’s mission, legacy, and commitment to empowering Australian traders, visit About Wealth Within.

Trade Smart, Stay Ahead

Uncertainty may dominate the headlines, but for informed investors, it represents opportunity. Energy, defence, and gold stocks are shaping up to be among the strongest performers in 2026, provided you know how to identify trends early and manage risk with precision.

As the team reminds us each week:

“It’s not about luck, it’s about learning how to trade properly.”